Essay

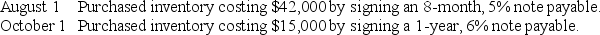

Davies Accessories Company entered into the following transactions relating to notes payable:

Required:

Required:

Prepare journal entries to record the above transactions.Also,prepare journal entries needed on December 31,the company's fiscal year end.Omit explanations.

Correct Answer:

Verified

Correct Answer:

Verified

Q81: Notes payable due in six months are

Q82: On December 31,2019,Accrued Warranty Payable is reported

Q83: The international accounting standard for loss contingencies:<br>A)contains

Q84: The balance of the Unearned Revenue account

Q85: A contingent liability should be disclosed in

Q87: Current liabilities are mostly for:<br>A)operating activities<br>B)financing activities.<br>C)investing

Q88: Examples of long term debt would include:<br>A)Notes

Q89: Most long-term debt agreements are structured to

Q90: On December 31st,Baxtor,Inc.has cost of goods sold

Q91: The most frequently used current liabilities are:<br>A)accounts