Essay

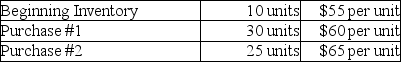

Carboni Company had the following data available for the current month:

Assume 40 units were sold during the month.Sales Revenue for the month is $7,000 and operating expenses are $2,200.The income tax rate is 30%.

Assume 40 units were sold during the month.Sales Revenue for the month is $7,000 and operating expenses are $2,200.The income tax rate is 30%.

Required:

Compute cost of goods sold using:

a.FIFO

b.LIFO

Correct Answer:

Verified

a.FIFO Cost of Goods...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q16: The use of the FIFO method generally

Q17: Slowinski Corporation reported net income of $465,000

Q18: The cost of the inventory that a

Q19: Perfect Catering Company's ending inventory was $103,700

Q20: By having knowledge of the company's inventory

Q22: Dole Company uses the periodic inventory system.At

Q23: Summertime had the following data for the

Q24: The cost-of-goods-sold model is:<br>A)beginning inventory,plus purchases,plus ending

Q25: The seller does not include consigned merchandise

Q26: Marian Company reported the following items for