Multiple Choice

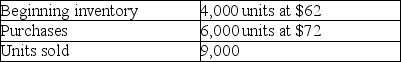

Using the following data,by how much would taxable income change if FIFO is used rather than LIFO?

A) Decrease by $10,000.

B) Decrease by $90,000.

C) Increase by $10,000.

D) Increase by $90,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q100: On August 1,Savage Company purchased $2,100 of

Q101: Which of the following is a CORRECT

Q102: Since a perpetual inventory system continuously updates

Q103: Service entities report cost of goods sold

Q104: Speedy Corporation reported net income of $465,000

Q106: Under the periodic inventory system,the journal entry

Q107: A fire destroyed the inventory and store

Q108: IFRS defines market value for inventory as

Q109: Under U.S.GAAP,the application of the lower-of-cost-or-market rule

Q110: Thomas Industries reported the following: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB6907/.jpg"