Essay

Carboni Company had the following data available for the current month:

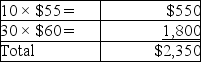

FIFO Cost of Goods Sold:

LIFO Cost of Goods Sold:

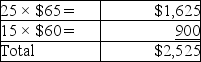

LIFO Cost of Goods Sold:

The income tax rate is 30%.

The income tax rate is 30%.

Required:

How much would Carboni Company save in income taxes if they used LIFO instead of FIFO?

Correct Answer:

Verified

($2,525 - ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q74: If a company uses LIFO for tax

Q75: There is an error in computing ending

Q76: The lower-of-cost-or-market rule is based on the

Q77: An error in ending inventory creates errors

Q78: The inventory method used by a company

Q80: Tomasino's inventory records show the following data

Q81: Under the periodic inventory system:<br>A)the Inventory account

Q82: The following data was obtained from the

Q83: How does the disclosure principle help financial

Q84: Another term for gross profit is:<br>A)gross income.<br>B)gross