Multiple Choice

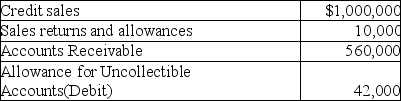

At the end of the year,Smith Company has the following information available:  The company uses the percent-of-sales method to estimate uncollectible accounts and has not prepared the year-end adjusting entry for Uncollectible-Account Expense.In the prior year,uncollectible accounts were estimated at 1% of credit sales.What action should Smith Company take in regards to uncollectible accounts at the end of the current year?

The company uses the percent-of-sales method to estimate uncollectible accounts and has not prepared the year-end adjusting entry for Uncollectible-Account Expense.In the prior year,uncollectible accounts were estimated at 1% of credit sales.What action should Smith Company take in regards to uncollectible accounts at the end of the current year?

A) increase the percentage in the percent-of-sales method

B) reexamine credit policies,especially the extension of credit

C) change to the direct write-off method

D) A and B

Correct Answer:

Verified

Correct Answer:

Verified

Q24: Accounts (trade)receivable are amounts to be collected

Q25: Journalize the following transactions for The Technology

Q26: On July 8,ABC Plumbing provided services of

Q27: A company has net credit sales of

Q28: Generally Accepted Accounting Principles (GAAP)allow companies to

Q30: Accounts receivable represents a form of extending

Q31: The balance in the Allowance for Uncollectible

Q32: The general ledger has a separate account

Q33: The aging-of-receivables method for estimating uncollectible accounts:<br>A)results

Q34: Days' sales in receivables is also called:<br>A)days'