Essay

Consider the following INDEPENDENT situations for Tommy Company:

a.The Allowance for Uncollectible Accounts has a $1,200 credit balance prior to adjustment.Net credit sales during the year are $830,000 and 2% are estimated to be uncollectible.Accounts Receivable has a balance of $110,000 at the end of the year.The company uses the percent-of-sales method.

b.The Allowance for Uncollectible Accounts has a $900 credit balance prior to adjustment.Based on an aging schedule of accounts receivable prepared at the end of the year,$20,000 of accounts receivable are estimated to be uncollectible.Accounts Receivable has a balance of $104,000 at the end of the year.

c.The Allowance for Uncollectible Accounts has a $16,300 debit balance prior to adjustment.Based on an aging schedule of accounts receivable prepared at the end of the year,$200,000 of accounts receivable are estimated to be uncollectible.Accounts Receivable has a balance of $958,000 at the end of the year.

d.The Allowance for Uncollectible Accounts has a $500 credit balance prior to adjustment.Net credit sales during the year are $900,000 and 1% are estimated to be uncollectible.Accounts Receivable has a balance of $825,000 at the end of the year.The company uses the percent-of-sales method.

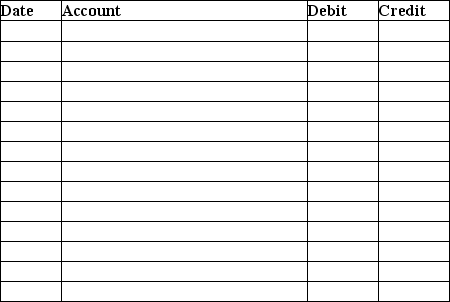

Required:

Prepare the adjusting journal entries for uncollectible accounts for each INDEPENDENT situation.Explanations are not required.

Correct Answer:

Verified

Correct Answer:

Verified

Q10: The maturity value of a note is

Q11: Which of the following is considered to

Q12: At December 31 of the current year,Accounts

Q13: Emma Jones Company has the following information

Q14: Robin's Nest had net credit sales for

Q16: When calculating the quick ratio,_ is included

Q17: Accounts receivable are reported on the balance

Q18: The allowance method records Uncollectible-Account Expense:<br>A)in the

Q19: Companies are not required to estimate expected

Q20: The following item appeared on a balance