Multiple Choice

Which of the following entries would be recorded by a company that uses the cash basis method of accounting?

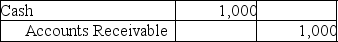

A)

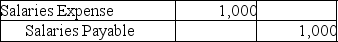

B)

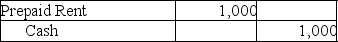

C)

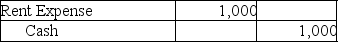

D)

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q51: Anthony Delivery Service has a weekly payroll

Q57: Maxwell Tax Planning Service bought communications equipment

Q103: The key differences between the cash basis

Q125: The partial worksheet of Browning Furniture is

Q127: Reece Consultants had the following balances before

Q135: Which of the following entries would be

Q149: Which of the following is the correct

Q170: Which of the following statements is TRUE

Q209: A worksheet is an external document that

Q220: Big Rig Delivery Service has the following