Essay

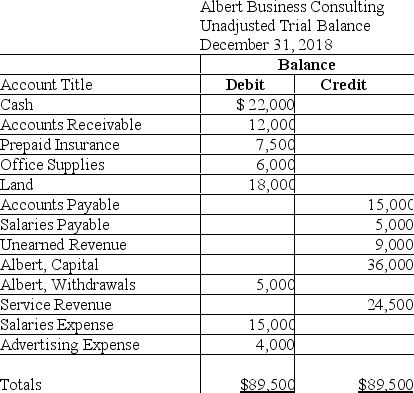

The unadjusted trial balance of Albert Business Consulting at December 31,2018,and the data for the adjustments follow:

Albert is preparing financial statements for the year ending December 31,2018.

Albert is preparing financial statements for the year ending December 31,2018.

Adjustment data at December 31 follows:

a.Albert pays its employees each Friday.December 31,2018 falls on a Monday.The employees will earn $1,250 for the five-day work week.

b.On August 31,2018,Albert agreed to provide consulting services to Smith Company for 6 months,beginning on September 1,2018,at $1,500 per month.Smith paid $9,000 on August 31,2018.Albert treats deferred revenues initially as liabilities.

c.Albert prepaid 6 months of business insurance on September 30,2018.The insurance begins on October 1.Albert treats deferred expenses initially as assets.

d.On December 31,2018,Albert received a bill for the November and December advertising in a local newspaper,$800.This bill will be paid on its due date,which is January 10,2019.

e.As of December 31,2018,Albert had performed services for Alliance Company for $5,000.The invoice will be sent on January 5,2019 and payment is due on January 15,2019.Albert received the payment on its due date.

Requirement

1.Prepare the adjusting journal entries at December 31,2018.

2.Prepare the adjusted trial balance at December 31,2018.Include a proper heading.

Correct Answer:

Verified

Correct Answer:

Verified

Q46: The accountant for Barnes Auto Repair Company

Q62: The accounting records for Social Event Planning

Q77: Unearned revenue is recorded when _.<br>A) revenue

Q97: The employees of Sinclair Services Company worked

Q102: Adjusting entries record revenues in the period

Q106: The accountant of Newton Legal Services failed

Q112: On June 1,Edison Company borrowed $27,000 on

Q135: Prepaid Rent is an expense account that

Q154: On September 1,Patterson Maintenance Company contracted to

Q171: The accountant for Diamond Jewelry Repair Services