Multiple Choice

A sole proprietorship has the following transactions: The business received $20,000 cash from the owner in exchange for capital.

The business purchases $600 of office supplies on account.

The business purchases $3,000 of furniture on account.

The business performs services to various clients totaling $11,000 on account.

The business pays out $3,000 for salaries expense and $4,500 for rent expense.

The business pays $600 to a supplier for the office supplies purchased earlier.

The business collects $2,000 from one of its clients for services rendered earlier in the month.

At the end of the month,all journal entries are posted to the ledger.Accounts Payable will appear as

Which of the following?

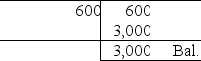

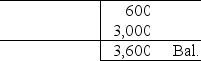

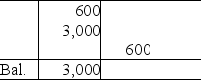

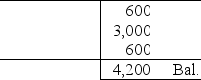

A) Accounts Payable

B) Accounts Payable

C) Accounts Payable

D) Accounts Payable

Correct Answer:

Verified

Correct Answer:

Verified

Q4: A note receivable represents an oral promise

Q18: A business makes a payment in cash

Q20: The account title used for recording a

Q41: Which of the following journal entries would

Q41: Which of the following is an asset

Q45: A business collects cash from a customer

Q67: Which of the following is a liability

Q81: The first step in the journalizing and

Q130: For revenues,the category of account and its

Q143: The Salaries Payable account is a(n)_.<br>A) liability