Multiple Choice

Sunset Company has a policy of accruing $2300 for every employee as a vacation benefit.Sarah,an employee,took a vacation.Which of the following is the correct journal entry for the vacation benefit paid?

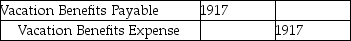

A)

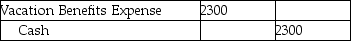

B)

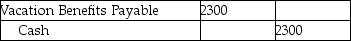

C)

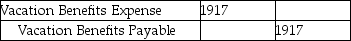

D)

Correct Answer:

Verified

Correct Answer:

Verified

Q11: Direct deposits decrease the efficiency of the

Q27: Retirement compensation is a benefit because the

Q33: Which of the following accounts is debited

Q50: All earnings are subject to Medicare tax.

Q62: Keith,an employee of Sunbeam,Inc.,has gross salary for

Q65: Classic Sales Company offers warranties on all

Q83: Analyze the following independent situations.<br>Required: For each

Q141: Federal unemployment compensation tax (FUTA)is not withheld

Q151: FICA tax is paid by the employee

Q170: Jason,an employee of Fitzgerald,Inc.,has gross salary for