Multiple Choice

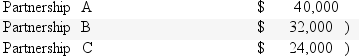

Alice is an attorney and earned $175,000 from her practice in the current year.Alice also owns three passive activities.The activities had the following income and losses:  What is Alice's adjusted gross income for the current year?

What is Alice's adjusted gross income for the current year?

A) $175,000.

B) $215,000.

C) $159,000.

D) $119,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q1: Itemized deductions are allowed in their entirety

Q28: The at-risk amount is increased each tax

Q29: In 2014,Mary invested $200,000 in a business

Q30: In 2016,Nigel contributes cash of $10,000 in

Q31: Libby owns and operates Mountain View Inn,a

Q33: Jacob is single with no dependents.During 2016,Jacob

Q34: In 2016,Ethan contributes cash of $50,000 and

Q36: Elijah owns an apartment complex that he

Q39: If a limited partner materially participates in

Q59: The Tara Partnership (not involved in real