Multiple Choice

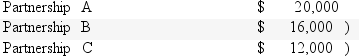

Spencer has an ownership interest in three passive activities.In the current tax year,the activities had the following income and losses:  How much in passive losses can Spencer deduct?

How much in passive losses can Spencer deduct?

A) $0.

B) $12,000.

C) $20,000.

D) $16,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q1: Itemized deductions are allowed in their entirety

Q3: There is no difference between regular tax

Q10: The term "passive activity" includes any activity

Q17: Bailey owns a 20% interest in a

Q18: Jordan purchased a warehouse for $600,000.$100,000 of

Q20: When determining whether a limited partnership loss

Q21: After computing all tax preferences and AMT

Q23: Catherine purchased furniture and fixtures 7-year property)for

Q25: The AMT tax rate for individuals is

Q39: If a limited partner materially participates in