Essay

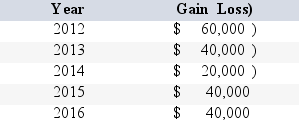

In 2012,Lindsay's at-risk amount was $50,000 at the beginning of the year.Lindsay's shares of income and losses from the activity were as follows ignore passive loss rules):

In 2016,what amount of income or loss will Lindsay report from this activity?

In 2016,what amount of income or loss will Lindsay report from this activity?

Correct Answer:

Verified

The following amounts would be...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q9: An equipment leasing activity is not subject

Q11: Gifts to charity are not allowed for

Q15: The initial amount considered at-risk is the

Q52: Terence and Alfred each invested $10,000 cash

Q59: The passive activity loss rules require income/loss

Q60: Jonathan is married,files a joint return,and has

Q61: Cal reported the following itemized deductions on

Q62: Heather purchased furniture and fixtures 7-year property)for

Q65: Which of the following increases the taxpayer's

Q66: Baxter invested $50,000 in an activity in