Essay

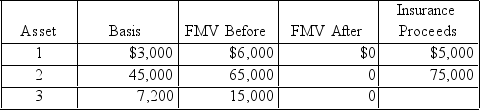

Knox operated a business which was damaged by a hurricane.His losses were as follows:

a.What is Knox's net casualty loss if any)assuming his AGI is $85,000 prior to the deduction? Assume he properly replaced all assets.

a.What is Knox's net casualty loss if any)assuming his AGI is $85,000 prior to the deduction? Assume he properly replaced all assets.

b.What is his basis in replacement Asset 1 purchased for $8,000 assuming Knox elected the non-recognition of gain from an involuntary conversion?

Correct Answer:

Verified

a.$7,200 business casualty loss.The invo...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q7: The exchange of a 5-year class asset

Q18: The election to defer a gain under

Q19: Sanjay exchanges a warehouse he uses in

Q21: The City of Greenville condemned 300 acres

Q22: Which of the following relationships are considered

Q25: In what instances,concerning involuntary conversions,must a taxpayer

Q26: Tanner,who is single,purchased a house on April

Q27: Basil,who is single,purchased a house on May

Q39: A wash sale occurs when a taxpayer

Q44: Julia exchanges a machine used in her