Multiple Choice

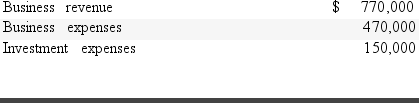

Alex,Ellen and Nicolas are equal partners in a local restaurant.The restaurant reports the following items for the current year:  Each partner receives a Schedule K-1 with one-third of the preceding items reported to him/her.How must each individual report these results on his/her Form 1040?

Each partner receives a Schedule K-1 with one-third of the preceding items reported to him/her.How must each individual report these results on his/her Form 1040?

A) $100,000 income on Schedule E; $50,000 investment expense on Schedule A

B) $300,000 income on Schedule E; $150,000 investment expense on Schedule A

C) $300,000 income on Schedule E; $50,000 investment expense on Schedule A

D) $257,667 income on Schedule E; $50,000 investment expense on Schedule A

Correct Answer:

Verified

Correct Answer:

Verified

Q3: When reporting the income and expenses of

Q58: On June 1<sup>st</sup><sup> </sup>of the current year,Kayla

Q59: Owen and Jessica own and operate an

Q61: Which of the following is not considered

Q63: A property that has been rented for

Q64: Jane and Don own a ski chalet

Q65: Which of the following is not considered

Q66: Nathan owns a tri-plex in Santa Maria,California.He

Q67: A property that has been rented for

Q87: What criteria determine a personal and rental