Multiple Choice

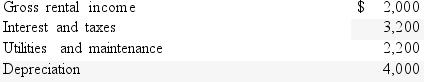

Lori and Donald own a condominium in Colorado Springs,Colorado,that they rent out part of the time and use during the summer.The rental property is classified as personal/rental property and their personal use is determined to be 75% based on the IRS method) .They had the following income and expenses for the year before any allocation) :  How much net loss should Lori and Donald report for their condominium on their tax return this year?

How much net loss should Lori and Donald report for their condominium on their tax return this year?

A) $0.

B) $7,400 loss.

C) $3,350 loss.

D) $9,000 loss.

Correct Answer:

Verified

Correct Answer:

Verified

Q20: A property rented for less than 15

Q38: Hugh and Mary own a cabin in

Q41: In the current year,Marnie rented her vacation

Q42: When royalties are paid,the amount paid is

Q46: Jamison owns a rental cabin in Mammoth,and

Q51: Rental properties that are also used as

Q54: What is meant by a passive activity?

Q65: In the case of a primarily personal

Q66: There are two methods available to taxpayers

Q76: Capital improvements on rental properties may be