Essay

Vladimir, Inc. began the current period with no inventories. During the period, it processed 50,000 pounds of materials costing $450,000. Conversion costs incurred during the period amounted to $660,000. The firm ended the period with no work-in-process. During the period, the firm produced 16,000, 24,000, and 10,000 units of X, Y, and Z, respectively. All costs are considered joint costs. The firm sold 12,000 units of X, 16,000 units of Y, and 9,000 units of Z. X sells for $30 per unit, Y for $44 per unit, and Z for $4 per unit. The firm uses the net realizable value method for cost allocation. Z is considered a by-product.

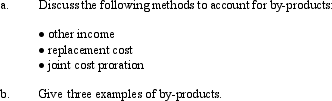

Required:

Correct Answer:

Verified

Correct Answer:

Verified

Q9: Rules of financial reporting (GAAP) require<br>A)that direct

Q12: Costs that are easily traced to individual

Q53: The split-off point is the ending point

Q88: Soy Products produces two products, Soyburgers and

Q91: Evergreen Company has two support departments (S1

Q92: Figure 7-7 Garden of Eden Company manufactures

Q96: Andover, Inc., has two producing departments. Each

Q98: Henderson Company pays a flat fee of

Q114: The choice of allocation method depends on

Q139: If the allocation is for product costing,