Multiple Choice

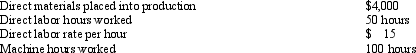

Figure 5 - 2 The Cameron Corporation manufactures custom-made purses. The following data pertains to Job XY5: Factory overhead is applied using a plant-wide rate based on direct labor hours. Factory overhead was budgeted at $80,000 for the year and the direct labor hours were estimated to be 20,000. Job XY5 consists of 50 units.

Factory overhead is applied using a plant-wide rate based on direct labor hours. Factory overhead was budgeted at $80,000 for the year and the direct labor hours were estimated to be 20,000. Job XY5 consists of 50 units.

Refer to Figure 5-2. What is overhead cost assigned to Job XY5?

A) $200

B) $400

C) $750

D) $1,500

Correct Answer:

Verified

Correct Answer:

Verified

Q1: Disadvantages of actual costing include<br>A) actual cost

Q8: Figure 5-9 The Omega Company manufactures customized

Q9: The entry that captures the flow of

Q10: A job-order costing process would be applicable

Q22: In job-order costing, departmental overhead rates and

Q81: When a job is completed the total

Q97: Inseparability refers to the<br>A)nonphysical nature of services

Q98: A production process may yield a tangible

Q111: Homogeneous products refer to<br>A)products similar in nature.<br>B)the

Q148: Heterogeneity refers to the<br>A) nonphysical nature of