Multiple Choice

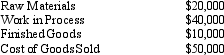

Figure 4-7 The Cherokee Company uses a predetermined overhead rate. The following accounts have these unadjusted balances: Refer to Figure 4-7. If Manufacturing overhead was $12,000 overapplied and considered immaterial, what is the journal entry?

Refer to Figure 4-7. If Manufacturing overhead was $12,000 overapplied and considered immaterial, what is the journal entry?

A) Cost of Goods Sold $12,000 Manufacturing Overhead $12,000

B) Manufacturing Overhead $12,000 Cost of Goods Sold $12,000

C) Manufacturing Overhead $12,000 Raw Materials $2,000

Work in Process $4,000

Finished Goods $1,000

Cost of Goods Sold $5,000

D) Raw Materials $2,000 Work in process $4,000

Finished Goods $1,000

Cost of Goods Sold $5,000

Manufacturing Overhead $12,000

E) Manufacturing Overhead $12,000 Work in Process $4,800

Finished Goods $1,200

Cost of Goods Sold $6,000

Correct Answer:

Verified

Correct Answer:

Verified

Q66: Figure 4-21 Appleby Manufacturing uses an activity-based

Q67: Figure 4-12 The Gardenview Corporation has identified

Q68: A(n) _ costing system first traces costs

Q70: Figure 4-21 Appleby Manufacturing uses an activity-based

Q72: Lonestar Corporation uses a job-order costing system

Q73: Figure 4-15 Carriage Manufacturing uses an activity-based

Q76: Figure 4-10 The Manoli Company has collected

Q122: Activity-based costing assigns cost to cost objects

Q130: The difference between actual overhead and applied

Q144: Which of the following quantities is an