Multiple Choice

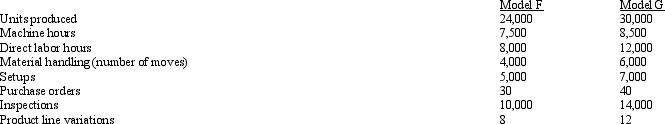

Figure 4-21 Appleby Manufacturing uses an activity-based costing system. The company produces Model F and Model G. Information relating to the two products is as follows:  The following overhead costs are reported for the following activities of the production process:

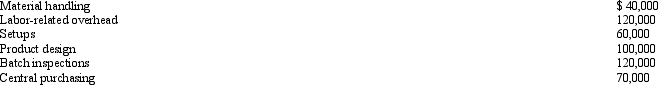

The following overhead costs are reported for the following activities of the production process: Jones manufacturing has used activity based costing to assign costs to Models F and G as given in the table below:

Jones manufacturing has used activity based costing to assign costs to Models F and G as given in the table below: Appleby Manufacturing wants to implement an approximately relevant ABC system by using the two most expensive activities for cost assignment.

Appleby Manufacturing wants to implement an approximately relevant ABC system by using the two most expensive activities for cost assignment.

Refer to Figure 4-21. Under this new approach, what cost would be assigned to materials handling?

A) 0

B) $40,000

C) $140,000

D) $290,000

Correct Answer:

Verified

Correct Answer:

Verified

Q47: If applied overhead is greater than actual

Q51: All of the following are unit-based activity

Q112: Figure 4-13 The Molotov plant of Kaboom

Q114: Figure 4-6 The Fast & Furious Company

Q115: The Data Retrieving Corporation provided the following

Q117: Figure 4-18 Marion Manufacturing uses an activity-based

Q119: The Anchorage plant of the Tundra Company

Q120: Figure 4-16 Samson Company recently installed an

Q168: All of the following are non-unit-based activity

Q185: A(n) _ is a grouping of logically