Multiple Choice

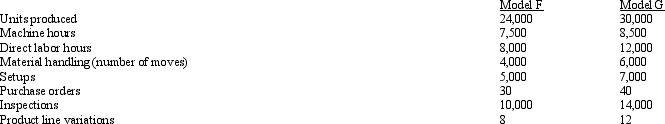

Figure 4-21 Appleby Manufacturing uses an activity-based costing system. The company produces Model F and Model G. Information relating to the two products is as follows:  The following overhead costs are reported for the following activities of the production process:

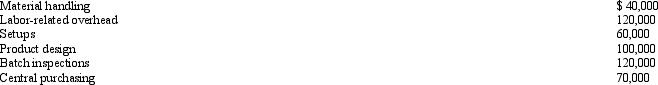

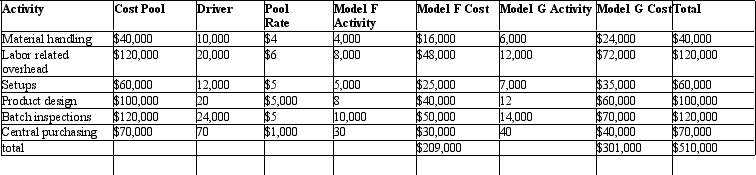

The following overhead costs are reported for the following activities of the production process: Jones manufacturing has used activity based costing to assign costs to Models F and G as given in the table below:

Jones manufacturing has used activity based costing to assign costs to Models F and G as given in the table below: Appleby Manufacturing wants to implement an approximately relevant ABC system by using the two most expensive activities for cost assignment.

Appleby Manufacturing wants to implement an approximately relevant ABC system by using the two most expensive activities for cost assignment.

Refer to Figure 4-21. Under this new approach, what cost would be assigned to the labor related cost pool?

A) 0

B) $120,000

C) $255,000

D) $315,000

Correct Answer:

Verified

Correct Answer:

Verified

Q6: Predetermined overhead rates are calculated at the

Q28: Figure 4-10 The Manoli Company has collected

Q29: Inventive Manufacturing Company has the following activities:

Q30: Figure 4-17 X-TREME Corporation has the following

Q32: Figure 4-21 Appleby Manufacturing uses an activity-based

Q34: Figure 4-14 Lawson Manufacturing has four categories

Q35: Maroone, Inc., has identified the following overhead

Q105: Classifying activities into four general categories facilitates

Q167: For labor-intensive operations, the most appropriate activity

Q176: The first step in designing an activity-based