Multiple Choice

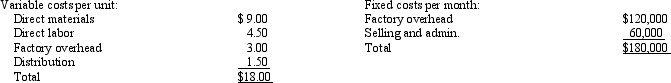

Hobart Company produces speakers for PA systems. The speakers are sold to retail music stores for $30. Manufacturing and other costs are as follows:  The variable distribution costs are for transportation to the retail music stores. The current production and sales volume is 20,000 per year. Capacity is 25,000 units per year.

The variable distribution costs are for transportation to the retail music stores. The current production and sales volume is 20,000 per year. Capacity is 25,000 units per year.

A Memphis manufacturing firm has offered a one-year contract to supply speaker parts at a cost of $6.00 per unit. If Hobart Company accepts the offer, it will be able to reduce variable costs by 30 percent and rent unused space to an outside firm for $18,000 per year. All other information remains the same as the original data. What is the effect on profits if Hobart Company buys from the Memphis firm?

A) decrease of $19,000

B) increase of $19,000

C) increase of $6,000

D) increase of $13,000

Correct Answer:

Verified

Correct Answer:

Verified

Q8: A decision to make or eliminate an

Q9: The following information relates to a product

Q10: Mystical Corporation manufactures a single product with

Q11: Davidian Company uses a joint process to

Q12: Figure 17-1 The following data pertains to

Q15: Zildjian Corporation manufactures a single product with

Q21: Which of the following items would be

Q57: Tactical cost analysis uses cost data to

Q69: Qualitative factors that should be considered when

Q91: Which of the following is NOT a