Multiple Choice

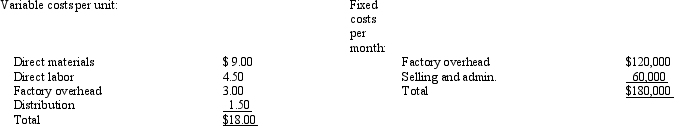

Modesto Company produces CD Players for home stereo units. The CD Players are sold to retail stores for $30. Manufacturing and other costs are as follows:  The variable distribution costs are for transportation to the retail stores. The current production and sales volume is 20,000 per year. Capacity is 25,000 units per year.

The variable distribution costs are for transportation to the retail stores. The current production and sales volume is 20,000 per year. Capacity is 25,000 units per year.

A San Diego wholesaler has proposed to place a special one-time order of 10,000 units at a reduced price of $24 per unit. The wholesaler would pay all distribution costs, but there would be additional fixed selling and administrative costs of $3,000. All other information remains the same as the original data. What is the effect on profits if the special order is accepted?

A) increase of $12,000

B) increase of $57,000

C) increase of $75,000

D) decrease of $168,000

Correct Answer:

Verified

Correct Answer:

Verified

Q11: A keep-or-drop decision uses irrelevant cost analysis

Q21: Relevant costs are<br>A)past costs.<br>B)future costs.<br>C)full costs.<br>D)cost drivers.

Q24: If there is excess capacity, the minimum

Q26: A sunk cost is irrelevant because it

Q73: In a keep-or-drop decision, the _ income

Q105: An irrelevant cost is one that is

Q106: Figure 17-1 The following data pertains to

Q108: Figure 17-1 The following data pertains to

Q111: Rosario Manufacturing Company had the following unit

Q114: Campbell Company has an annual capacity of