Essay

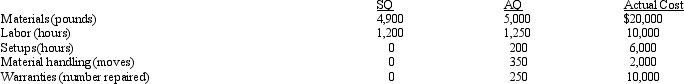

Metropolitan, Inc., sells one of its products for $40 each. Sales volume averages 2,000 units per year. Recently, its main competitor reduced the price of its product to $28. Metropolitan expects sales to drop dramatically unless it matches the competitor's price. In addition, the current profit per unit must be maintained. Information about the product (for production of 2,000) is as follows:

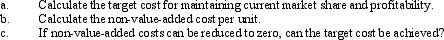

Required:

Required:

Correct Answer:

Verified

Correct Answer:

Verified

Q12: Value-added costs are standard costs based on<br>A)

Q21: The effort expended to identify those factors

Q41: A firm's warranty costs are £125,000 per

Q71: Cost reduction is a measure of activity

Q93: Performance measurement is concerned with how well

Q109: Which of the following is descriptive of

Q121: Which of the following is NOT an

Q131: Mattison Company has developed cost formulas for

Q139: Activity-based costing does not provide good information

Q144: Nonvalue-added activities<br>A) are unnecessary inputs.<br>B) are valued