Multiple Choice

Table 18-4

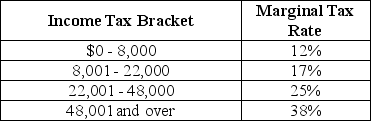

Table 18-4 shows the income tax brackets and tax rates for single taxpayers in Calpernia.

-Refer to Table 18-4.Calculate the income tax paid by Sasha,a single taxpayer with an income of $60,000.

A) $22,800

B) $14,399

C) $13,800

D) $13,642

Correct Answer:

Verified

Correct Answer:

Verified

Q30: Rapid economic growth tends to increase the

Q46: What is the poverty rate?<br>A)the rate at

Q80: One argument advanced in favor of reducing

Q98: If the marginal tax rate is greater

Q107: Between 1980 and 2011,income inequality in the

Q132: The voting paradox suggests that the "voting

Q170: What is regulatory capture?<br>A)It is a situation

Q193: Explain the effect of price elasticities of

Q233: Why is a typical person likely to

Q255: An average tax rate is calculated as<br>A)total