Multiple Choice

Table 18-4

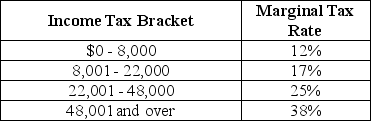

Table 18-4 shows the income tax brackets and tax rates for single taxpayers in Calpernia.

-Refer to Table 18-4.Sasha is a single taxpayer with an income of $60,000.What is his marginal tax rate and what is his average tax rate?

A) marginal tax rate = 38%; average tax rate = 23%

B) marginal tax rate = 17%; average tax rate = 21%

C) marginal tax rate = 38%; average tax rate = 24%

D) marginal tax rate = 23%; average tax rate = 38%

Correct Answer:

Verified

Correct Answer:

Verified

Q30: Rapid economic growth tends to increase the

Q80: One argument advanced in favor of reducing

Q93: Economists argue that the corporate income tax

Q97: One important difference between the political process

Q148: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB3018/.jpg" alt=" Figure 18-2 shows

Q170: What is regulatory capture?<br>A)It is a situation

Q171: Gasoline taxes that are typically used for

Q174: A situation where a member of Congress

Q215: The federal corporate income tax is<br>A)regressive.<br>B)proportional.<br>C)progressive.<br>D)unfair.

Q258: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB3018/.jpg" alt=" Figure 18-2 shows