Multiple Choice

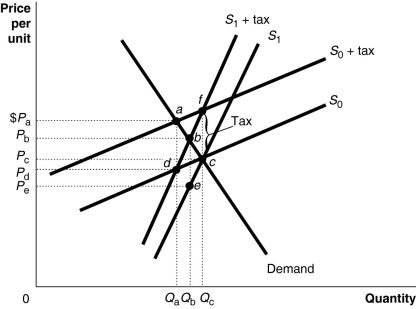

Figure 18-2  Figure 18-2 shows a demand curve and two sets of supply curves, one set more elastic than the other.

Figure 18-2 shows a demand curve and two sets of supply curves, one set more elastic than the other.

-Refer to Figure 18-2. If the government imposes an excise tax of $1.00 on every unit sold, the consumer's burden of the tax

A) is Pa - Pc under either supply curve.

B) is Pb - Pc under either supply curve.

C) is Pa - Pc if the supply curve is S0 and Pb - Pc if the supply curve is S1.

D) is Pa - Pd if the supply curve is S0 and Pb - Pe if the supply curve is S1.

Correct Answer:

Verified

Correct Answer:

Verified

Q40: A marginal tax rate is calculated as<br>A)total

Q88: For the top 1 percent of income

Q95: Employees _ income tax on their wages

Q108: An income tax system is _ if

Q128: If you pay $2,000 in taxes on

Q138: Congressman Gallstone seeks support from his colleagues

Q143: The marginal tax rate is<br>A)the amount of

Q172: "For a given supply curve, the excess

Q217: Of the following sources of tax revenue

Q222: If you pay $3,000 in taxes on