Multiple Choice

A partner invests into a partnership a building with a $50,000 carrying value and $80,000 fair market value.The related mortgage payable of $25,000 is assumed by the partnership.The entry to record the investment in partnership is:

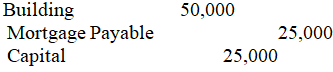

A)

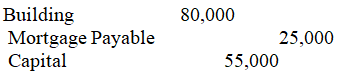

B)

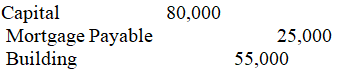

C)

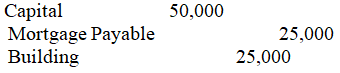

D)

Correct Answer:

Verified

Correct Answer:

Verified

Q124: Which of the following describes a joint

Q125: Partner X purchases Partner Y's $25,000 interest

Q126: Erin,Rachel,and Travis are partners in ERT Company,with

Q127: A partner invests into a partnership a

Q128: A _ is an association of two

Q130: Chelsea,Harold,and Ryan are liquidating their business.They share

Q131: A limited partnership<br>A)allows some partners to limit

Q132: A partner invests into a partnership a

Q133: Austin invests $80,000 for a 20 percent

Q134: Cortney invests $80,000 for a 10 percent