Multiple Choice

A partner invests into a partnership a building with a $50,000 carrying value and $40,000 fair market value.The related mortgage payable of $25,000 is assumed by the partnership.The entry to record the investment in partnership is:

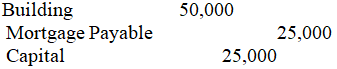

A)

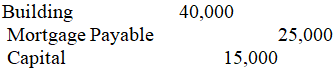

B)

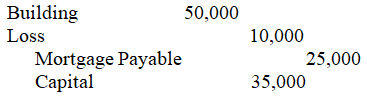

C)

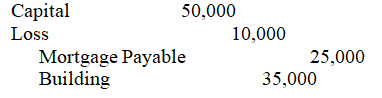

D)

Correct Answer:

Verified

Correct Answer:

Verified

Q122: Which of the following statements is correct

Q123: Leah,Cameron,and Ryan each receive a $20,000 salary,as

Q124: Which of the following describes a joint

Q125: Partner X purchases Partner Y's $25,000 interest

Q126: Erin,Rachel,and Travis are partners in ERT Company,with

Q128: A _ is an association of two

Q129: A partner invests into a partnership a

Q130: Chelsea,Harold,and Ryan are liquidating their business.They share

Q131: A limited partnership<br>A)allows some partners to limit

Q132: A partner invests into a partnership a