Essay

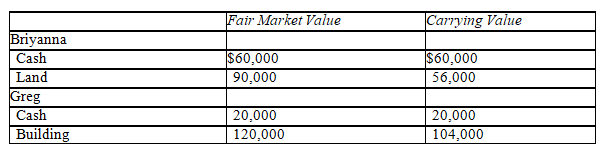

Briyanna and Greg form a partnership and invest the following assets and liabilities.Greg's building is subject to a $40,000 mortgage that is not assumed by the partnership.

In the journal provided prepare the entry to record the formation of the partnership.(Omit explanation. )

Correct Answer:

Verified

Correct Answer:

Verified

Q50: Admission of a new partner never has

Q73: List four advantages and four disadvantages of

Q75: Fred,Kristina,and Nick each receive a $14,000 salary,as

Q77: Which of the following methods of distributing

Q78: Delta and Chen form a partnership and

Q80: Gains on the sale of assets in

Q82: It is possible to allocate income to

Q83: Income is divided equally among the partners

Q84: Which of the following will not result

Q116: When a new partner is admitted,it will