Essay

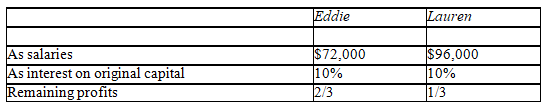

Eddie and Lauren are partners in a business.Eddie's original capital contribution was $80,000,and Lauren's was $120,000.They agreed to share profits as follows:

Calculate each partner's share of profits,assuming (a)the profit was $200,000,and, (b)the profit was $140,000.

Calculate each partner's share of profits,assuming (a)the profit was $200,000,and, (b)the profit was $140,000.

Correct Answer:

Verified

a.Eddie,$88,000 Laur...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q16: Which of the following will not result

Q20: Each partner is personally liable only for

Q27: Which of the following is correct?<br>A)Total assets

Q51: When a partner invests assets other than

Q61: Which of the following does not result

Q66: Disadvantages of a partnership include<br>A)facilitates pooling of

Q69: Which of the following is incorrect regarding

Q74: Justin and Nicole are forming a partnership.What

Q93: After selling all the assets and paying

Q102: When a partner invests a noncash asset