Paul,Quinn,and Ralph Have Equities in a Partnership of $120,000,$180,000,and $100,000,respectively,and

Essay

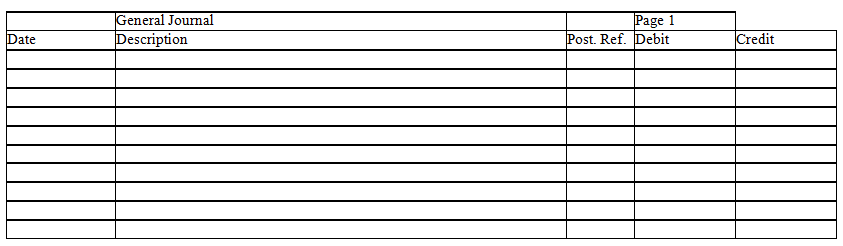

Paul,Quinn,and Ralph have equities in a partnership of $120,000,$180,000,and $100,000,respectively,and share income in a ratio of 2:1:2,respectively.The partners have agreed to admit Sandy to the partnership.Prepare entries in journal form without explanations to record the admission of Sandy to the partnership under each of the following assumptions:

a.Sandy invests $100,000 for a 30 percent interest,and a bonus is recorded for Sandy.

b.Sandy invests $150,000 for a one-fifth interest,and a bonus is recorded for the old partners.

Correct Answer:

Verified

Correct Answer:

Verified

Q16: Which of the following will not result

Q20: Each partner is personally liable only for

Q27: Which of the following is correct?<br>A)Total assets

Q45: Lexi invests $80,000 for a one-fourth interest

Q61: Which of the following does not result

Q66: Partnership liquidation is not the same as

Q71: When a partner withdraws from a partnership,an

Q89: Partners' Withdrawals accounts have normal debit balances.

Q93: After selling all the assets and paying

Q106: A partnership agreement need not be in