Multiple Choice

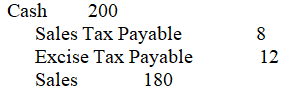

A company receives $200,of which $8 is for sales tax and $12 is for excise tax.The journal entry to record the sale is:

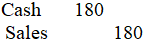

A)

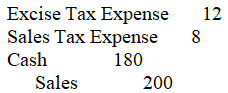

B)

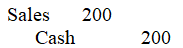

C)

D)

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q148: Margo Dhang is paid $8 per hour

Q149: During August,Radio City sold 200 ipods for

Q150: Expected obligations arising from programs,such as frequent

Q151: Marta Company had cash sales of $120,000

Q152: Lawsuits against a company in connection with

Q154: Which of the following typically would not

Q155: Which of the following does not represent

Q156: The FUTA tax rate most often actually

Q157: Which of the following most likely is

Q158: Potential vacation pay should be accounted for