Essay

Nexus Star Inc.produces various kinds of oils.One of its product,Product X,is made from castor oil,beeswax,aloe vera,and a base compound.

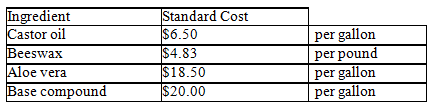

For the next 12 months,the company's purchasing agent believes that the cost of ingredients will be as follows:

The direct labor time standard is 3.50 hours per unit at a standard direct labor rate of $12.00 per hour.The standard overhead rates are $15.00 per direct labor hour for the standard variable overhead rate and $13.00 per direct labor hour for the standard fixed overhead rate.

a.Using these production standards,compute the standard unit cost of direct materials per unit if it takes 0.50 gallon of castor oil,1 pound of beeswax,0.25 gallon of aloe vera,and 1 gallon of base compound to produce one unit of product X.Round values to two decimal places.

b.Using the standard unit cost of direct materials per case determined in (a)and the production standards given for direct labor and overhead,compute the standard unit cost of one unit of product X.

Correct Answer:

Verified

Correct Answer:

Verified

Q11: The static budget can be adjusted automatically

Q13: Predetermined overhead costs are the same as

Q47: The direct labor rate variance is the

Q56: Robert Inc.uses the standard costing method.The company's

Q65: The variable overhead efficiency variance is the

Q70: A performance report should contain cost or

Q84: Discuss the keys to preparing a performance

Q98: The standard overhead cost is the sum

Q107: Which of the following costs generally do

Q114: A standard unit cost can be determined