Multiple Choice

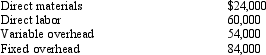

McGraw Inc.manufactures 12,000 units of a part used in its production to manufacture guitars.The annual production activities related to this part are as follows:  Hill Inc.has offered to sell 12,000 units of the same part to McGraw for $22 per unit.If McGraw were to accept the offer,some of the facilities presently used to manufacture the part could be rented to a third party at an annual rental of $18,000.Moreover,$4 per unit of the fixed overhead applied to the part would be totally eliminated.

Hill Inc.has offered to sell 12,000 units of the same part to McGraw for $22 per unit.If McGraw were to accept the offer,some of the facilities presently used to manufacture the part could be rented to a third party at an annual rental of $18,000.Moreover,$4 per unit of the fixed overhead applied to the part would be totally eliminated.

-In the decision to make or buy the part,what is the relevant fixed overhead for McGraw Inc.?

A) $30,000

B) $54,000

C) $84,000

D) $48,000

Correct Answer:

Verified

Correct Answer:

Verified

Q2: Special orders should be considered only when

Q71: Sales commission expenses are included in special

Q75: Identifying and prescribing corrective actions for short-run

Q77: With a special order decision,relevant qualitative factors

Q79: Alex International needs 20,000 units of a

Q81: Which of the following is subtracted from

Q85: Outsourcing is the use of suppliers outside

Q112: Outsourcing production help in reducing a company's

Q148: Why is the book value of equipment

Q179: There are products or services that can