Essay

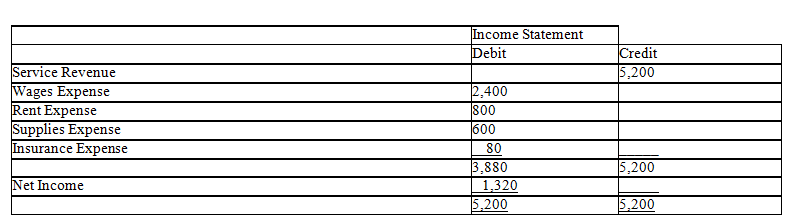

Prepare closing entries for December (omit explanations)from the following Income Statement columns of the work sheet of Kemp Corporation,assuming that a $1,000 withdrawal was made during the period.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q111: The Adjusted Trial Balance columns of the

Q112: Closing entries deal primarily with the balances

Q113: Owner's Capital is closed by transferring the

Q114: In preparing closing entries,which of the following

Q115: Omitting key letters in the work sheet

Q117: Under which circumstance would one less closing

Q118: The Income Statement columns of the work

Q119: Working papers provide a written record of

Q120: Use the following adjusted trial balance to

Q121: Reversing entries are made to correct errors