Essay

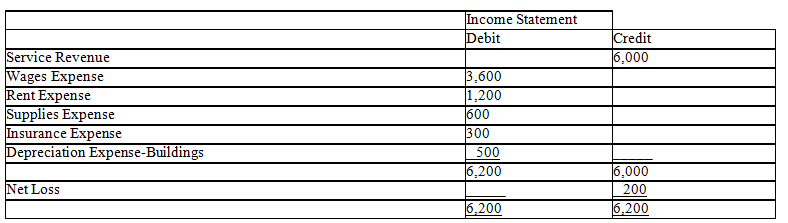

From the following items in the Income Statement columns of the work sheet of Sailors Co.at December 31,20x5,prepare the closing entries without explanations,assuming that a $100 withdrawal was made by the owner during the period.

Correct Answer:

Verified

Correct Answer:

Verified

Q9: Closing entries ultimately will affect<br>A)total liabilities.<br>B)the Cash

Q10: Probably the last account to be listed

Q11: Use the following adjusted trial balance to

Q12: Indicate in the spaces below whether each

Q13: Use the following adjusted trial balance to

Q15: Which of the following accounts could appear

Q16: Preparing the worksheet and closing entries provide

Q17: When there is a net loss,the entry

Q18: Which of the following accounts might appear

Q19: In preparing adjustments on the work sheet,which