Multiple Choice

Use this information pertaining to Tucson Company to answer the following question. 1.The corporation's Supplies account showed a beginning debit balance of $400 and supplies purchased of $1,600.There were $600 of supplies on hand at year end.

2) Depreciation on a building is estimated to be $10,000.

3) A one-year insurance policy was purchased for $4,800.Five months have passed since the purchase.

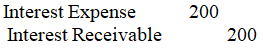

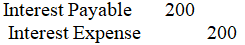

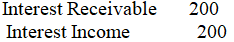

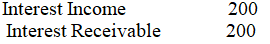

4) Accrued interest on a note receivable amounted to $200.

5) The company received a $3,600 advance payment during the year on services to be performed.By the end of the year,one-third of the services had been performed.

The adjusting entry to record the accrued interest on the note is

A)

B)

C)

D)

Correct Answer:

Verified

Correct Answer:

Verified

Q96: Which of the following is an example

Q97: The Supplies account had a $720 debit

Q98: Susan Kane won the mayoral election in

Q99: A company's fiscal year need not correspond

Q100: State whether each situation is a deferral

Q102: Which of the following accounts would not

Q103: Accrual accounting recognizes revenues and expenses at

Q104: Which of the following transactions results in

Q105: Which of the following accounts would be

Q106: If an adjusting entry is not made