Essay

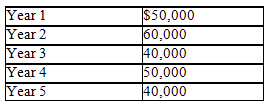

The following data have been gathered for a capital investment decision.

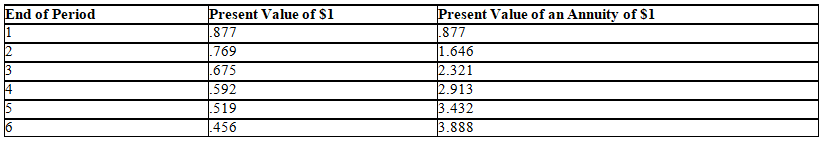

Minimum rate of return for this investment is 14 percent.The present value factors for 14 percent discount rate are given below.

a.Compute the present value of each of the cash inflows of the investment.

b.What would have been the present value of the cash flows if they were received in equal installments over the five-year period at the same discount rate? (Assume the total cash inflows remain same. )

c.If the answers to parts (a)and (b)differ,explain the reason(s)why.

Correct Answer:

Verified

a.

b.$240,000  5 = $48,000 per year

5 = $48,000 per year

$4...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

b.$240,000

$4...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q168: The alternative with the lowest payback period

Q169: Depending on the mixture of sources of

Q170: A project is accepted under the net

Q171: The accounting rate-of-return is calculated by dividing

Q172: Capital investment analysis ensures that the resources

Q174: When resources like direct material,labor,or time are

Q175: Capital investment analysis involves all of the

Q176: The Cal-Fruit Company specializes in decorative fruit

Q177: A special order should be accepted only

Q178: The Pink Thai Restaurant is considering the