Essay

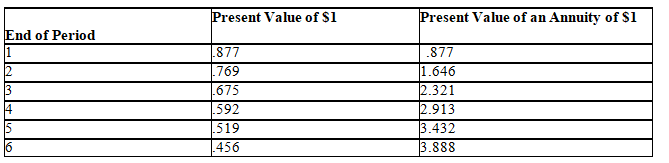

The following data have been gathered for a capital investment decision.The amounts relate to a 14 percent discount factor.

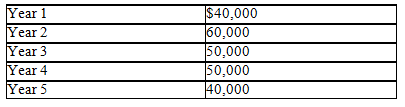

a.Compute the present value of the following cash flows.Use a discount rate of 14 percent.

b.What would have been the present value of the cash flows if they were received in equal installments over the five-year period at the same discount rate?

c.If the answers to parts (a)and (b)differ,explain the reason(s)why.

Correct Answer:

Verified

a.

b.$240,000  5 = $48,000 per year

5 = $48,000 per year

$4...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

b.$240,000

$4...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q121: Capital investment decisions are decisions about when

Q122: The point at which products are separated

Q123: The cost of debt,the cost of preferred

Q124: When using the net present value method

Q125: Discuss the qualitative factors that should be

Q127: A segment margin is a segment's sales

Q128: The term incremental cost refers to<br>A)the difference

Q129: The fixed costs that are traceable to

Q130: The payback period is based on a

Q131: Many management decisions are unique and hence