Essay

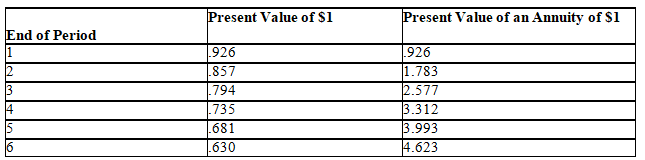

You are given the following present value factors at 8 percent,The Rogers Company's minimum desired rate of return: The Rogers Company is considering the replacement of a piece of equipment.The old machine has a carrying value of $800 and a remaining estimated life of five years,with no residual value at that time.Present residual value is $200.The new equipment will cost $1,200,including transportation and installation.It has an estimated life of five years,with no residual value then.Annual cash operating costs are $400 for the old machine and $150 for the new machine.(Round your answers to two decimal places. )

The Rogers Company is considering the replacement of a piece of equipment.The old machine has a carrying value of $800 and a remaining estimated life of five years,with no residual value at that time.Present residual value is $200.The new equipment will cost $1,200,including transportation and installation.It has an estimated life of five years,with no residual value then.Annual cash operating costs are $400 for the old machine and $150 for the new machine.(Round your answers to two decimal places. )

a.Compute the present value of the operating cash outflows for the old machine.

b.Compute the present value of the operating cash outflows for the new machine.

c.Compute the present value of the cash operating savings if the new machine is purchased.

d.What is the net present value of the replacement alternative?

Correct Answer:

Verified

a.Present value = $400 ´ 3.993 = $1,597....View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q114: Net present value analysis is based on

Q115: Products Green,Red,and White have unit contribution margins

Q116: Automating the existing production process comes under

Q117: Taylor Inc.manufactures 12,000 units of a part

Q118: In choosing among alternatives,managers are guided by

Q120: Information that is the same for all

Q121: Capital investment decisions are decisions about when

Q122: The point at which products are separated

Q123: The cost of debt,the cost of preferred

Q124: When using the net present value method