Essay

Management of Moore City Trust is in the process of evaluating the purchase of a new check sorting machine.The model under review will cost $44,000 and will require installation costs of $5,000.Similar machines have a ten-year life,and management has estimated that this sorter will have a residual value of $2,500 at the end of its life.Annual cost savings to be generated by the sorter will average $9,500 over the ten-year period.Management's minimum desired before-tax rate of return is 14 percent.

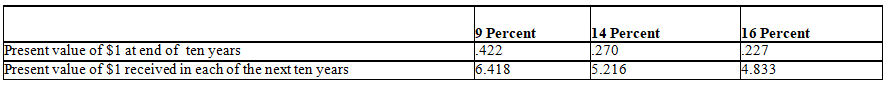

Present value multipliers:

a.Using before-tax information and the net present value method to evaluate this capital investment,determine whether the company should purchase the check sorting machine.Support your answer.

a.Using before-tax information and the net present value method to evaluate this capital investment,determine whether the company should purchase the check sorting machine.Support your answer.

b.If management had decided on a minimum desired before-tax rate of return of 16 percent,should the check sorting machine be purchased? Show all computations to support your answer.Round answers to nearest dollar.

Correct Answer:

Verified

a.Decision on purchase of machine,using ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q175: Capital investment analysis involves all of the

Q176: The Cal-Fruit Company specializes in decorative fruit

Q177: A special order should be accepted only

Q178: The Pink Thai Restaurant is considering the

Q179: There are products or services that can

Q180: Courtney Sinclaire is trying to rent a

Q181: The common costs shared by two or

Q183: Fresno Manufacturing Company specializes in the production

Q184: Availability of funds is one of the

Q185: Which of the following methods uses the