Essay

Nexus Star Inc.produces various kinds of oils.One of its product,Product X,is made from castor oil,beeswax,aloe vera,and a base compound.

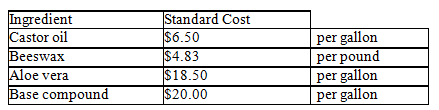

For the next 12 months,the company's purchasing agent believes that the cost of ingredients will be as follows:

The direct labor time standard is 3.50 hours per unit at a standard direct labor rate of $12.00 per hour.The standard overhead rates are $15.00 per direct labor hour for the standard variable overhead rate and $13.00 per direct labor hour for the standard fixed overhead rate.

a.Using these production standards,compute the standard unit cost of direct materials per unit if it takes 0.50 gallon of castor oil,1 pound of beeswax,0.25 gallon of aloe vera,and 1 gallon of base compound to produce one unit of product X.Round values to two decimal places.

b.Using the standard unit cost of direct materials per case determined in (a)and the production standards given for direct labor and overhead,compute the standard unit cost of one unit of product X.

Correct Answer:

Verified

Correct Answer:

Verified

Q43: Candy Stores Inc.gives you the following information:

Q44: It is not necessary to provide an

Q45: Choco Sweet Inc.gives you the following information:

Q46: Which of the following yields the standard

Q47: The direct labor rate variance is the

Q49: Underfoot Products uses standard costing.The following information

Q50: James Corporation's controller has developed the cost

Q51: The standard fixed overhead rate is usually

Q52: Underfoot Products uses standard costing.The following information

Q53: Crazy Cars Corporation's flexible budget for 30,000