Essay

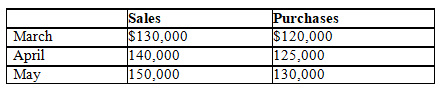

The expected sales for Uptown Clothing in the month of May are shown in the table below.Chelsea Rogers,the owner,gives credit to a select group of customers (20 percent of sales),but all others must pay cash.Of Chelsea's credit customers,80 percent pay her the month after the sale and 20 percent in the second month after sales.

Chelsea pays cash for 10 percent of her purchases.The other 90 percent she pays off by the end of the next month.Chelsea's operating expenses are paid the month after incurrence.Her operating expenses are about $7,000 each month,$500 of which is depreciation.Selling expenses have a fixed and a variable component.The fixed is $1,500 a month,and the variable is 10 percent of sales.Chelsea began May with $9,000 in cash. Prepare a cash budget to determine Uptown Clothing's ending cash balance for May.

Prepare a cash budget to determine Uptown Clothing's ending cash balance for May.

Correct Answer:

Verified

Correct Answer:

Verified

Q24: Which of the following do not serve

Q25: A sales forecast for a retail organization

Q26: Receipt of stock dividends,depreciation,and amortization expense will

Q27: Once cash receipts and cash payments have

Q28: If the cash budget of a company

Q30: Budgeting is the process of identifying,gathering,summarizing,and communicating

Q31: Managers do not need to know why

Q32: The cost of goods manufactured budget is

Q33: Lee Carter Inc.forecast of sales is as

Q34: Richard Inc.expects to sell 28,000 units.Each unit