Essay

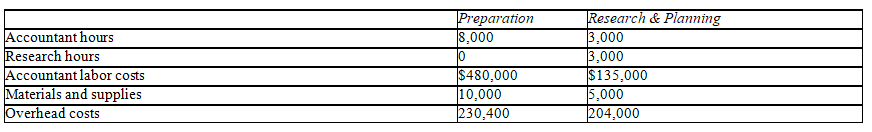

Morgan & Morgan is a small firm that assists clients in the preparation of their tax returns.The firm has five accountants and five researchers,and it uses job order costing to determine the cost of each client's return.The firm is divided into two departments: (1)Preparation and (2)Research & Planning.Each department has its own overhead application rate.The Preparation Department's rate is based on accountant labor costs and Research & Planning is based on the number of research hours.The following is the company's estimates for the current year's operations.

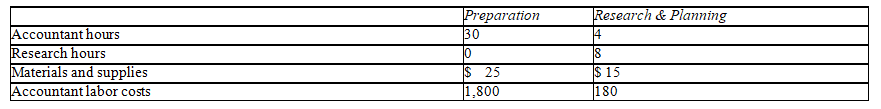

Client No.2006-713 was completed during April of the current year and incurred the following costs and hours:

a.Compute the overhead rates to be used by both departments.

b.Determine the cost of Client No.2006-713,by department and in total.

Correct Answer:

Verified

a.Preparation Department overh...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q39: The _ provides the most direct means

Q40: The process of assigning a collection of

Q41: Pretty Pillows,Mfg. ,manufactures silk throw pillows.Last month

Q42: Job costs in a service organization end

Q43: The traditional approach to applying overhead costs

Q45: Managers prepare financial statements to communicate the

Q46: Costs assigned to the building of a

Q47: The production process determines the product costing

Q48: Cardsheet Company The following partially completed T

Q49: The following information is available at the