Multiple Choice

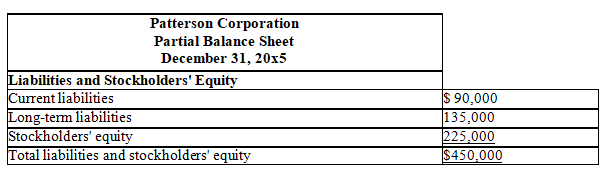

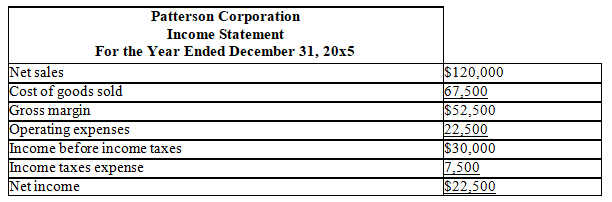

The following information pertains to Patterson Corporation.Assume that all balance sheet amounts represent both average and ending figures.

Patterson Corporation had 6,000 shares of common stock issued and outstanding.The market price of Patterson common stock on December 31,20x5,was $20.Patterson paid dividends of $0.90 per share during 20x5.

Patterson Corporation had 6,000 shares of common stock issued and outstanding.The market price of Patterson common stock on December 31,20x5,was $20.Patterson paid dividends of $0.90 per share during 20x5.

-What is the debt to equity ratio for this corporation? Round your answer to 1 decimal place.

A) 0.4 times

B) 0.6 times

C) 1.0 times

D) 2.5 times

Correct Answer:

Verified

Correct Answer:

Verified

Q5: A common measure of long-term solvency is

Q6: An example of vertictal analysis is<br>A)common-size statements.<br>B)trend

Q7: Payables turnover measures the relative size of

Q8: In general,the greater the investment risk taken,the

Q9: Annual financial statements are subjected to a

Q11: The length of the operating cycle equals

Q12: Why is the quick ratio probably better

Q13: A company that is leveraged is one

Q14: Common-size statements are useful in assessing the

Q15: Consistency requires that a company use the