Multiple Choice

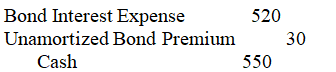

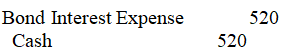

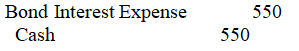

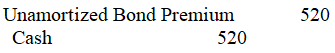

A ten-year bond has a face value of $10,000,a face interest rate of 11 percent,an unamortized bond premium of $400,and an effective interest rate of 10 percent.The bonds were issued on one of its semi-annual interest payment dates.The entry to record the bond interest expense on the first semi-annual interest payment date is : (assuming the effective interest method of amortization) ,

A)

B)

C)

D)

Correct Answer:

Verified

Correct Answer:

Verified

Q47: The debt to equity ratio is expressed

Q48: Bond issue costs have the effect of

Q49: Russell Corporation issued $224,000 of 12 percent

Q50: The entry to record the issuance of

Q51: Under a defined benefit pension plan,<br>A)actuarial computations

Q53: Term bonds are of shorter duration than

Q54: A $200,000 bond issue with a carrying

Q55: When bonds are sold at face value

Q56: Parson Company issues $500,000 of 30-year,8 percent

Q57: Unamortized Bond Premium is subtracted from Bonds