Multiple Choice

Use the following information to answer the question below. On January 1,20x5,Falcon Corporation had 40,000 shares of $10 par value common stock issued and outstanding.All 40,000 shares had been issued in a prior period at $17 per share.On February 1,20x5,Falcon purchased 3,100 shares of treasury stock for $19 per share and later sold the treasury shares for $26 per share on March 2,20x5.

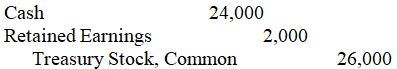

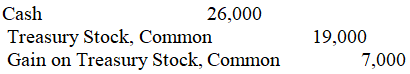

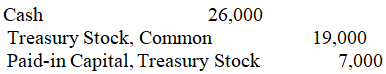

-The entry to record the sale of the treasury shares on March 2,20x5 is

A)

B)

C)

D)

Correct Answer:

Verified

Correct Answer:

Verified

Q72: Which of the following items will not

Q73: A disadvantage of the corporate form of

Q74: Use this information to answer the following

Q75: A corporation cannot declare a dividend that

Q76: A stock dividend exceeding 20 to 25

Q78: Define outstanding stock.

Q79: Start-up and organization costs include all of

Q80: Compensation expense related to employee stock options

Q81: If Grant Corporation has 120,000 shares of

Q82: When common stock is issued by a