Multiple Choice

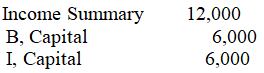

Partners B and I receive a salary allowance of $6,000 and $14,000,respectively,and share the remainder equally.If the company earned $8,000 during the period,the entry to close the income or loss into their capital accounts is:

A)

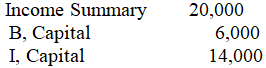

B)

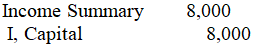

C)

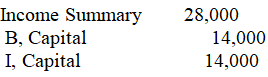

D)

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q1: Accounting for a partnership comes closer to

Q2: The entities forming joint ventures usually involve

Q3: On December 31,20x5,the R & J Partnership

Q5: A partnership is an accounting entity separate

Q6: Under the partnership form of business,it may

Q7: Which of the following methods of distributing

Q8: The use of salaries in the allocation

Q9: April and Cammy are partners who have

Q10: When the existing partners pay a bonus

Q11: A partnership agreement should include the method