Multiple Choice

Partners K and R receive an interest allowance of $20,000 and $30,000,respectively,and divide the remaining profits and losses in a 3:1 ratio.If the company sustained a net loss of $22,000 during the year,the entry to close the income or loss into their capital accounts is:

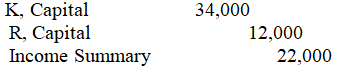

A)

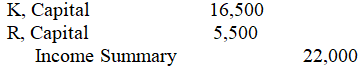

B)

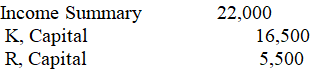

C)

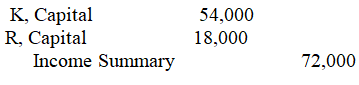

D)

Correct Answer:

Verified

Correct Answer:

Verified

Q135: Unlimited liability refers to<br>A)a claim to the

Q136: Which of the following will not result

Q137: In a partnership liquidation,the Gain or Loss

Q138: When a new partner is admitted,the old

Q139: It is possible for a partner's Capital

Q141: When a newly admitted partner pays a

Q142: Shannon,Thomas,and Williman are in a partnership that

Q143: Alex,Clinton,and Evan are in a partnership.Evan decides

Q144: A limited partnership normally has one or

Q145: Juan invests $120,000 for a one-fifth interest